https://www.extremetech.com/computi...e-the-industry-slump-with-higher-wafer-prices

TLDR;

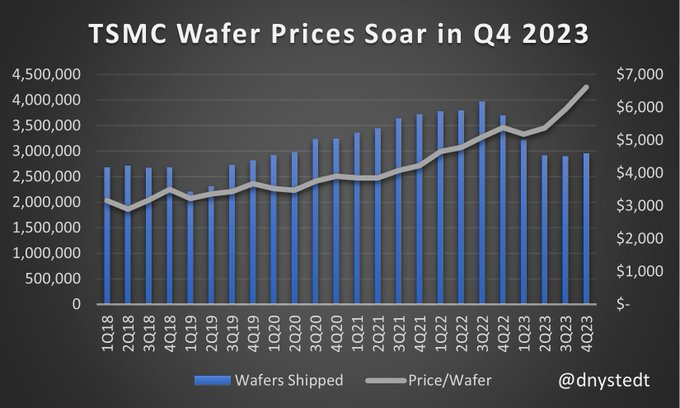

TSMC charged 22% more in 2023 than it did in 2022, so even though orders were down across the board they maintained their numbers.

TSMC raised prices more on newer nodes than they did on older ones

TLDR;

TSMC charged 22% more in 2023 than it did in 2022, so even though orders were down across the board they maintained their numbers.

TSMC raised prices more on newer nodes than they did on older ones

Last edited:

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)