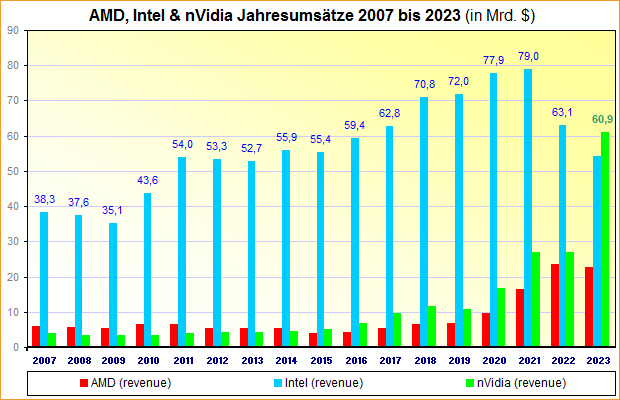

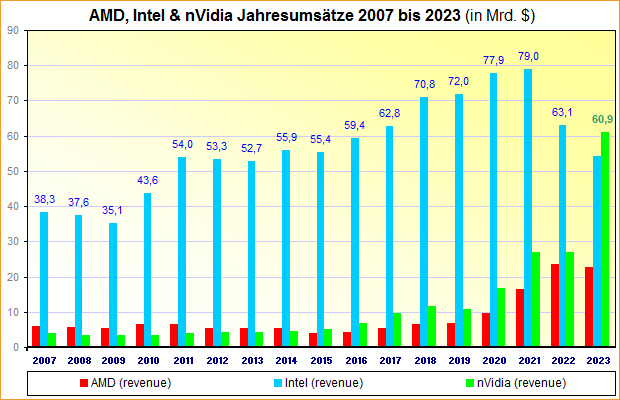

nVidia made the big leap with its 2023 annual results and dethroned Intel as the clear leader of the three big chip developers in the PC sector for ages. Of course, this is partly based on a period of weakness on Intel's part, as nVidia is currently not (yet) close to Intel's sales records from 2019/20 (however, based on the forecast for the first quarter, this could be targeted in 2024) . But this is a remarkable development, especially given the very clear difference in sales in the years before 2020: AMD and nVidia had well under a tenth (!) of Intel sales for many years.

https://m-3dcenter-org.translate.go...2023?_x_tr_sl=auto&_x_tr_tl=en&_x_tr_hl=en-GB

Overall, it can be said that nVidia has clearly become an "HPC/AI company": Everything else is really just a side business when the data center division is more than 6 times as large as the gaming division in the past quarter ( or the quarterly growth of the data center division is significantly greater than the entire gaming division) . And there is no end to this development in sight, as nVidia is forecasting further sales growth to $24.0 billion (±2%) for the current first quarter, presumably once again driven by the AI accelerator business. Even higher figures can be expected for the rest of the year, after all, the first quarter of the year is usually never particularly busy. How far it will go is of course uncertain; at some point the current AI boom may come to a certain end.

For now, however, it has been enough to skyrocket nVidia to roughly six times its sales within just four years. Interestingly, the current AI boom was not solely responsible for this: in 2020 there was the IT boom of the Corona period, then in 2021 there was the cryptomining hype - and only subsequently did the HPC business and later the AI business take off. business significantly. It remains to be seen how this enormous increase in size and importance will change the company in the medium and long term. The important but actually only medium-sized chip developer of the years before 2020 has now become one of the only six companies in the world with a share value of over a trillion dollars (the others: Meta (Facebook), Alphabet (Google), Amazon, Apple & Microsoft) .

https://m-3dcenter-org.translate.go...2023?_x_tr_sl=auto&_x_tr_tl=en&_x_tr_hl=en-GB

Overall, it can be said that nVidia has clearly become an "HPC/AI company": Everything else is really just a side business when the data center division is more than 6 times as large as the gaming division in the past quarter ( or the quarterly growth of the data center division is significantly greater than the entire gaming division) . And there is no end to this development in sight, as nVidia is forecasting further sales growth to $24.0 billion (±2%) for the current first quarter, presumably once again driven by the AI accelerator business. Even higher figures can be expected for the rest of the year, after all, the first quarter of the year is usually never particularly busy. How far it will go is of course uncertain; at some point the current AI boom may come to a certain end.

For now, however, it has been enough to skyrocket nVidia to roughly six times its sales within just four years. Interestingly, the current AI boom was not solely responsible for this: in 2020 there was the IT boom of the Corona period, then in 2021 there was the cryptomining hype - and only subsequently did the HPC business and later the AI business take off. business significantly. It remains to be seen how this enormous increase in size and importance will change the company in the medium and long term. The important but actually only medium-sized chip developer of the years before 2020 has now become one of the only six companies in the world with a share value of over a trillion dollars (the others: Meta (Facebook), Alphabet (Google), Amazon, Apple & Microsoft) .

https://www.cnbc.com/amp/2024/02/14...rket-cap-now-third-most-valuable-us-firm.html

Guys… big green is closing in on Microsoft and Apple. This is nuts!

Nvidia’s stock is up over 250% from just 1 year ago. Intel and AMD have been left for dead.

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)