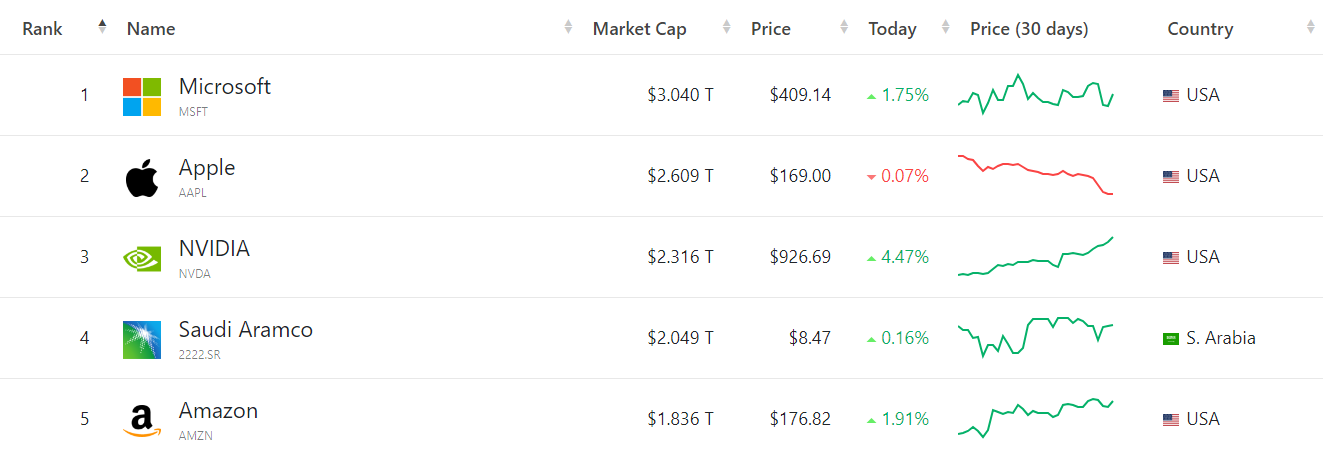

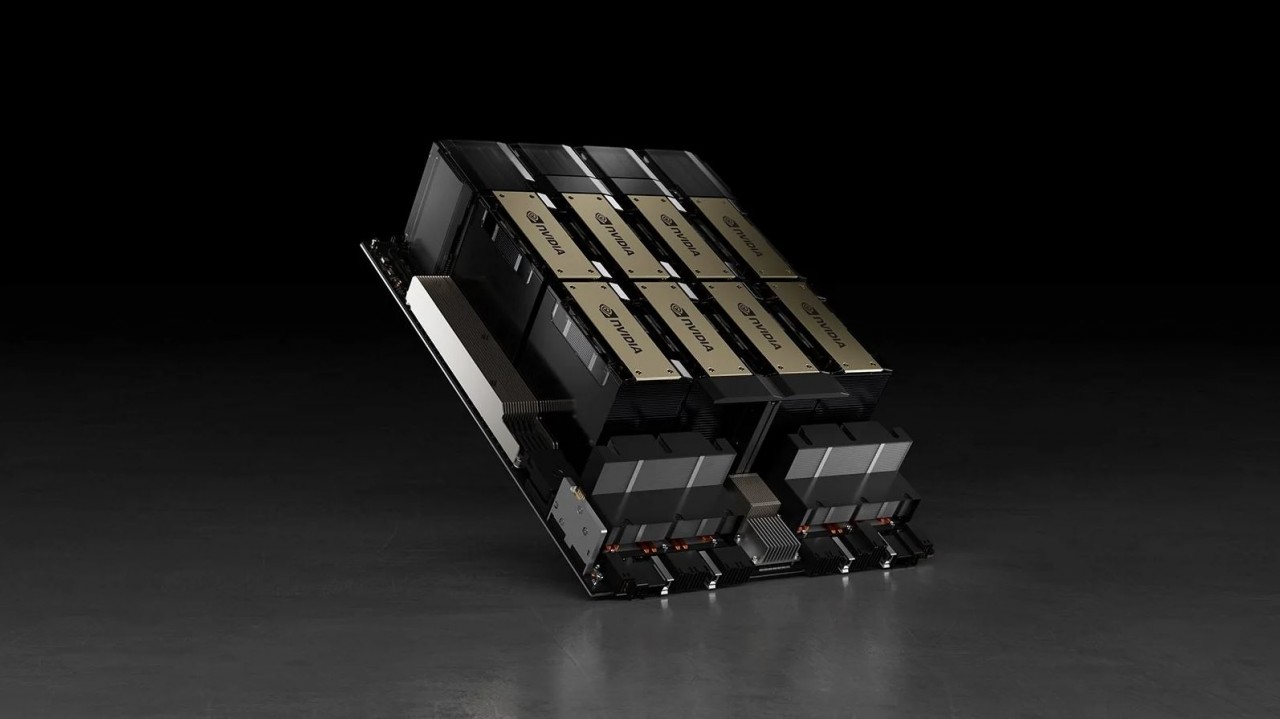

Market analysts are repricing nvidia so much that they don’t even know what to make of Nvidia now being the third most valuable company nipping at Apple’s heel.

https://www.thestreet.com/investing...val-price-targets-as-new-business-model-grows

https://www.thestreet.com/investing...val-price-targets-as-new-business-model-grows

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)