pippenainteasy

[H]ard|Gawd

- Joined

- May 20, 2016

- Messages

- 1,158

I am not sure to which point you are addressing, I imagine wealth gap ?

I feel actual mensuality versus income (and household income not just median income)

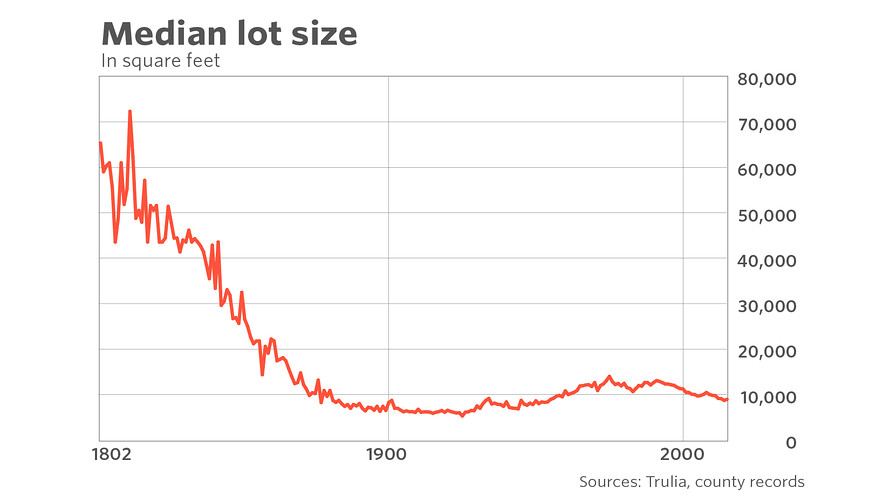

The house size more up by more than 2.5x since I think (compare the median house over time can be a bit like the median car and looking at the price of a Corolla over time when the Corolla of today is bigger than the Camry of the past), people buy themselve 5 time more house by person than back in the days, which seem to indicate that people got much richer, but buy more:

View attachment 409361

It is true that by square feet it is really constant over time and it is not something that got cheaper, but I am not sure what it tell us about wealth gap that the median household can afford such high price and such big house, is that a sign of the median being the rich of yesterday and a diminution of the wealth gap of it's rise ?

The house size point is way overemphasized. Houses used to come on large lots, these days you barely get any land at all with new construction. In many parts of the country, the land is worth far more than the house. That's the point the inflation downplayers never emphasize I notice. It's a very interesting omission that in many ways gives away the game they play (which is status quo defense).

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)