erek

[H]F Junkie

- Joined

- Dec 19, 2005

- Messages

- 10,875

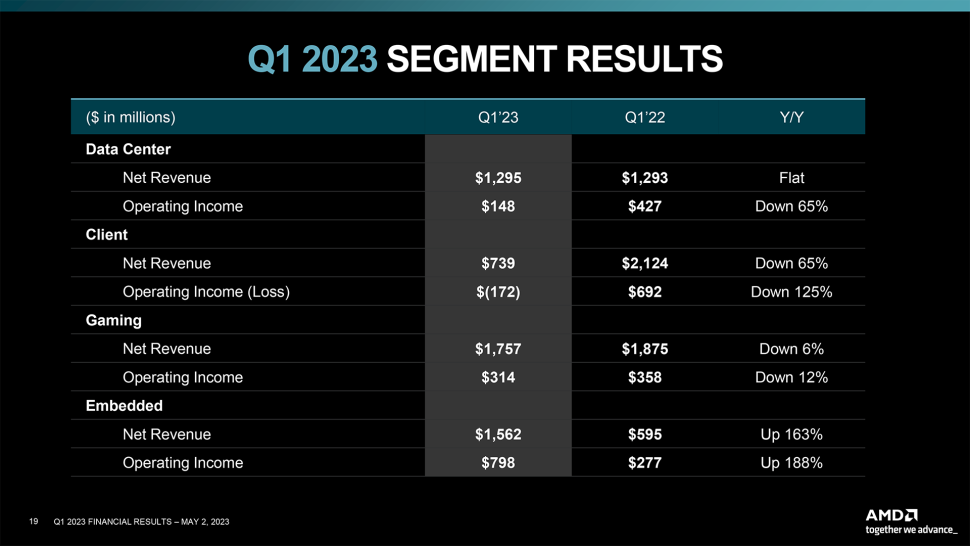

"Furthermore, AMD plans to formally introduce its EPYC 'Bergamo' CPUs for cloud data centers and EPYC 'Genoa-X' for high-performance technical computing applications. While ramps of server CPUs tend to be slow, these parts will still allow AMD to increase its sales of data center hardware slightly.

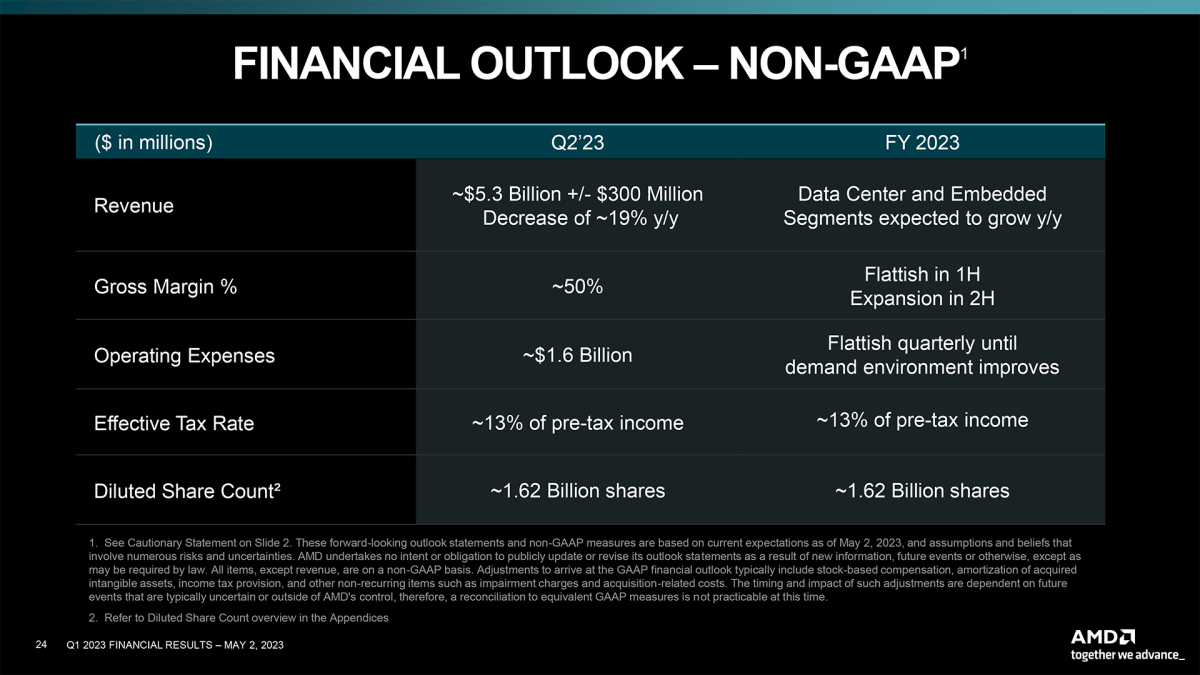

"For the second quarter, we expect sequential growth in our Data Center and Client segments offset by modest declines in our Gaming and Embedded segments," said AMD's chief financial officer. "We remain confident in our growth in the second half of the year as the PC and server markets strengthen and our new products ramp."

Meanwhile, AMD remains optimistic about strong demand for its products in the second half and beyond. For example, the firm expects its data center sales to beat 2022 this year.

"Looking longer term, we have significant growth opportunities ahead based on successfully delivering our roadmaps and executing our strategic datacenter and embedded property have priorities led by accelerating adoption of our AI products," Su said."

Source: https://www.tomshardware.com/news/amd-posts-first-loss-in-years-in-q1-2023

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)